Common Mistakes Made by Policyholders During the Claims Process.

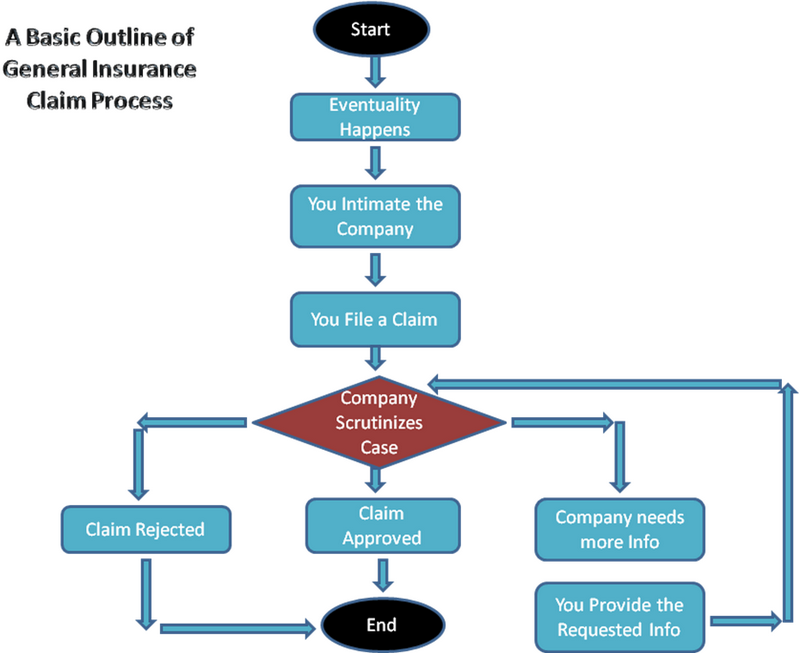

Policyholders often encounter challenges and difficulties during the claims process. While claims are typically straightforward, mistakes can be made that can jeopardize the outcome of your claim. It is important to be aware of these common mistakes and take steps to avoid them, ensuring a smoother and more successful claims process.

One common mistake made by policyholders is failing to provide all the necessary documentation and evidence to support their claim. This can delay the process and potentially result in a denied claim. It is crucial to gather all relevant documents, including police reports, medical records, and any other evidence that supports your claim. By providing comprehensive documentation, you increase your chances of a successful claim.

Another mistake policyholders often make is not reporting the claim promptly. Delaying the reporting of a claim can lead to complications and make it harder to substantiate your case. It is essential to report your claim as soon as possible to ensure that any necessary investigations can be carried out promptly.

During the claims process, policyholders should be careful not to inadvertently admit fault or take blame for the incident. This can significantly impact the outcome of your claim. It is important to stick to the facts and avoid making any statements that could be misconstrued or used against you. Consulting with a lawyer or claims professional can help you navigate the process and ensure you do not make this mistake.

Avoid These Common Mistakes During the Claims Process – Policyholder Tips

When it comes to filing insurance claims, policyholders often make common mistakes that can hinder the process. By being aware of these mistakes, you can avoid unnecessary delays and frustrations. Here are some tips to help policyholders navigate the claims process:

- Not reporting the claim promptly: One common mistake policyholders make is failing to report the claim to their insurance company in a timely manner. It is important to notify your insurer as soon as possible after the incident occurs.

- Failing to document the damages: Another mistake is not thoroughly documenting the damages. Take clear and detailed photographs or videos of the damage to support your claim. Keep track of all related expenses and receipts as well.

- Not reviewing the policy: Many policyholders do not carefully review their insurance policy before filing a claim. It is crucial to understand the coverage limits, exclusions, and requirements outlined in the policy. This will help you avoid any surprises during the claims process.

- Improperly filing the claim: Policyholders often make mistakes when filling out the claim forms. Double-check all the information you provide to ensure its accuracy. Any mistakes or discrepancies can delay the processing of your claim.

- Not following up: After filing a claim, it is important to stay in touch with your insurance company and regularly follow up on the status of your claim. This will help you stay informed and address any issues in a timely manner.

- Settling too quickly: Policyholders sometimes settle for less than they are entitled to. It is important to carefully evaluate the settlement offer and negotiate if necessary. Don’t be afraid to seek legal advice if you feel your claim is not being handled fairly.

By avoiding these common mistakes, policyholders can ensure a smoother and more efficient claims process. It’s important to be proactive, informed, and organized throughout the entire claims process to maximize your chances of a successful outcome.

Providing Incomplete Information

A common mistake made by policyholders during the claims process is providing incomplete information. It is important to provide all necessary details and documentation to support your claim. Failing to do so may result in delays or even denials of your claim.

When filing a claim, make sure to provide complete and accurate information about the incident. This includes providing a detailed description of what happened, the date and time of the incident, and any relevant photos or videos. It is also important to include all receipts, estimates, and other documentation related to the damages or losses you are claiming.

By providing incomplete information, you are not giving your insurance company the full picture of your claim. This can lead to misunderstandings or misinterpretations of the facts, which may result in your claim being undervalued or denied altogether.

Remember: the claims process is based on providing evidence and documentation to support your claim. By providing complete and accurate information, you increase your chances of a successful claim outcome.

Take the time to gather all necessary information and documentation before filing your claim. This will help ensure that your claim is processed smoothly and without unnecessary delays.

Failing to Document Damages

One of the most common mistakes made by policyholders during the claims process is failing to thoroughly document damages. This can significantly hinder the ability to successfully file a claim and receive the proper compensation.

When a loss occurs, it is crucial for policyholders to carefully document all damages, including taking photographs or videos of the affected property. This visual evidence provides a clear and objective record of the extent of the damages and can help substantiate the claim.

In addition to visual documentation, policyholders should also keep a detailed written record of the damages. This should include a description of the damage, the date and time it occurred, and any relevant details or circumstances. Keeping track of repairs or mitigating actions taken to prevent further damage is also important.

By failing to document damages thoroughly, policyholders may encounter difficulties in proving the extent of their losses to the insurance company. Insurers often require concrete evidence to support the claim, and without proper documentation, policyholders may find their claims denied or undervalued.

To avoid this common mistake, policyholders should create a system for documenting damages as soon as they occur. This could include keeping a designated folder or file for all related documents and photographs, as well as making note of any conversations or correspondence with the insurance company.

By taking the time to properly document damages, policyholders can greatly increase their chances of a successful claims process and ensure they receive the appropriate compensation for their losses.

Delaying Reporting the Claim

One of the common mistakes made by policyholders during the claims process is delaying reporting the claim. It is important for policyholders to report the claim as soon as possible to the insurance company. Delays in reporting the claim can lead to complications and may even result in the denial of the claim.

When a policyholder delays reporting the claim, it becomes difficult for the insurance company to investigate the incident and evaluate the damages accurately. This can lead to delays in the claims process and can potentially result in a lower payout for the policyholder.

Furthermore, delaying the report can also raise suspicions with the insurance company. They may question why the policyholder did not report the claim immediately after the incident. This can create doubts about the validity of the claim and may result in increased scrutiny or even denial of the claim.

To avoid these complications, policyholders should promptly report any claims to their insurance company. They should provide all the necessary details and evidence regarding the incident, such as photographs, police reports, or witness statements. By doing so, policyholders can ensure a smoother claims process and increase their chances of a successful claim settlement.

Not Seeking Professional Advice

One common mistake made by policyholders during the claims process is not seeking professional advice. It can be tempting to try to handle the claim on your own, but without proper guidance, you may end up making costly mistakes.

Insurance policies can be complex, and understanding the fine print can be overwhelming. By not seeking professional advice, you run the risk of misinterpreting the policy language and missing out on benefits that you are entitled to.

A professional, such as a public adjuster or an attorney, can provide valuable expertise and guidance throughout the claims process. They can help you understand your policy, assess the damages, and negotiate with the insurance company on your behalf.

Additionally, seeking professional advice can help ensure that you receive a fair settlement. Insurance companies are for-profit businesses, and their goal is to minimize claim payouts. With the help of a professional, you can level the playing field and maximize the compensation you receive.

So, don’t underestimate the importance of seeking professional advice during the claims process. It can help you avoid costly mistakes and ensure that you receive the benefits you deserve.

Accepting the First Offer

During the claims process, policyholders often make the common mistake of accepting the first offer made by the insurance company. While it may be tempting to quickly settle the claim and move on, policyholders must remember that the first offer is usually not the best offer.

Insurance companies are businesses, and their goal is to minimize their financial liability. They may offer a low amount in the hopes that the policyholder will accept it without questioning or negotiating. As a policyholder, it is important to carefully review the offer and consider all the damages and losses incurred.

In some cases, policyholders may underestimate the full extent of their damages or the cost of repairs. They may also overlook additional coverage or benefits that could be included in their policy. By accepting the first offer without thoroughly evaluating it, policyholders risk settling for less than what they are entitled to.

It is crucial for policyholders to gather all the necessary documentation, such as receipts, estimates, and expert opinions, to support their claim. They should also consult with professionals, such as public adjusters or attorneys, who can help negotiate a fair and reasonable settlement.

Policyholders should not be afraid to question the insurance company’s offer and seek clarification on any discrepancies. They should also be prepared to negotiate, providing evidence and arguments to support their position. By being proactive and assertive during the claims process, policyholders can increase their chances of obtaining a more favorable settlement.

In conclusion, accepting the first offer made by the insurance company is a common mistake policyholders should avoid. By carefully evaluating the offer, gathering necessary documentation, and seeking professional assistance, policyholders can ensure they receive the compensation they deserve.

Lacking Understanding of Policy Coverage

One of the most common mistakes made by policyholders during the claims process is lacking a clear understanding of their policy coverage. This can lead to misunderstandings and potentially denied claims.

It is important for policyholders to thoroughly read and familiarize themselves with the terms and conditions of their insurance policy. This includes understanding what is covered, what is excluded, and any specific requirements for filing a claim.

By not understanding the policy coverage, policyholders may inadvertently make mistakes when filing their claims. For example, they may fail to provide all the necessary documentation or miss important deadlines. This can result in delays or even denial of their claim.

To avoid this mistake, policyholders should take the time to review their policy carefully and ask their insurance provider any questions they may have. They should make sure they are aware of the coverage limits, deductibles, and any additional coverage options that may be available to them.

Having a clear understanding of their policy coverage will help policyholders navigate the claims process more effectively and increase their chances of a successful claim outcome.

Missing Deadlines

One of the most common mistakes made by policyholders during the claims process is missing deadlines. It is crucial to be aware of all the deadlines and timelines associated with your insurance claim. Failing to meet these deadlines can result in your claim being denied or delayed.

When a loss occurs, it is important to notify your insurance company as soon as possible. Many policies have a specific timeline for reporting a claim, and failing to do so within the designated time frame can lead to complications.

Additionally, there may be deadlines for submitting necessary documentation, such as proof of loss or medical records. These documents are often required to support your claim and failing to provide them in a timely manner can result in further delays or even a denial of your claim.

To avoid missing deadlines, it is essential to stay organized and keep track of important dates. Make sure to review your insurance policy carefully and be aware of any time limits or requirements. Consider setting reminders or using a calendar to help you stay on top of deadlines.

If you are unsure about any deadlines or requirements, don’t hesitate to reach out to your insurance company or an attorney specializing in insurance claims. They can provide guidance and help ensure that you meet all necessary deadlines throughout the claims process.

By being proactive and staying aware of deadlines, you can avoid one of the most common mistakes policyholders make during the claims process and increase the chances of a successful outcome for your insurance claim.

Overlooking Additional Expenses

During the claims process, policyholders often make the mistake of overlooking additional expenses that may arise as a result of the claim. It is important to remember that the cost of repairing or replacing damaged property is not the only expense that policyholders may incur.

There are other costs that can add up quickly, such as temporary housing, transportation, meals, and even the cost of hiring professionals to help with the claims process. These expenses can easily be overlooked, but they can have a significant impact on the overall financial burden of the claim.

To avoid this mistake, policyholders should carefully document any additional expenses that are related to the claim. This includes keeping receipts, invoices, and any other relevant documentation. By doing so, policyholders can ensure that they are properly compensated for all expenses incurred as a result of the claim.

Underestimating the Value of Losses

One of the most common mistakes made by policyholders during the claims process is underestimating the value of their losses. This can happen for a variety of reasons, such as not fully understanding the extent of the damage or not properly documenting the items that have been lost or damaged.

Underestimating the value of losses can lead to insufficient compensation from the insurance company, leaving policyholders to bear a significant financial burden. It is important for policyholders to carefully assess the value of their losses and provide accurate documentation to support their claims.

During the claims process, policyholders should take the time to thoroughly inventory their damaged or lost items and gather any relevant documentation, such as receipts, appraisals, or photographs. This will help ensure that the insurance company has a clear understanding of the value of the losses and can provide appropriate compensation.

Additionally, policyholders should be proactive in seeking professional assistance if needed, such as hiring a public adjuster who can help accurately assess the value of the losses and negotiate with the insurance company on their behalf.

By avoiding the mistake of underestimating the value of losses, policyholders can increase their chances of receiving fair compensation for their claims and minimize any financial hardship they may experience as a result of the loss or damage.

Neglecting to Review the Claim

One common mistake made by policyholders during the claims process is neglecting to thoroughly review the claim. Many policyholders fail to carefully read through all the details of their claim before submitting it, which can lead to misunderstandings and discrepancies with the insurance provider.

It is important for policyholders to take the time to review their claim and ensure that all the necessary information has been included. This includes double-checking the accuracy of the incident date, description of the loss, and documentation of any damages or expenses incurred.

By neglecting to review the claim, policyholders may overlook important details or fail to provide supporting documentation. This can result in delayed or denied claims, as well as potential disputes with the insurance company.

To avoid this mistake, policyholders should carefully review their claim before submitting it. They should make sure that all relevant information is included and accurate, and that any supporting documentation is attached. Taking the time to review the claim can help ensure a smoother and more successful claims process.

Not Following Up on the Claim

One common mistake made by policyholders during the claims process is not following up on their claim. After filing a claim, it’s important to stay proactive and keep in touch with the insurance company.

By not following up on the claim, policyholders may miss out on important updates or requests for additional information. This can lead to delays in the claims process or even a denial of the claim.

It’s crucial for policyholders to regularly communicate with the insurance company and provide any requested documentation or information in a timely manner. This will help ensure that the claim is being processed efficiently and accurately.

Key Takeaway:

Policyholders should avoid the mistake of not following up on their claim. By staying proactive and regularly communicating with the insurance company, they can help prevent delays or denials in the claims process.

Ignoring Clauses and Exclusions

One of the most common mistakes made by policyholders during the claims process is ignoring the clauses and exclusions in their insurance policies. Many people assume that their insurance will cover any type of loss or damage, only to find out later that certain events or circumstances are excluded from coverage.

It is important for policyholders to carefully review their insurance policies and be aware of any clauses or exclusions that may apply to their claims. These clauses and exclusions can vary depending on the type of policy and the insurance provider.

Ignoring these clauses and exclusions can result in a denied claim or a reduced payout. By understanding the specific terms and conditions of their policies, policyholders can better navigate the claims process and ensure that their claims are handled correctly.

| One common clause found in many insurance policies is the “Act of God” clause, which excludes coverage for natural disasters such as earthquakes, floods, and hurricanes. |

| Another common exclusion is the “Wear and Tear” clause, which excludes coverage for damage that occurs over time due to normal use or aging. |

| Some policies also have exclusions for intentional acts or criminal activities, meaning that they will not cover any losses or damages resulting from these actions. |

| It is crucial for policyholders to read and understand these clauses and exclusions to avoid any surprises or difficulties during the claims process. |

By taking the time to familiarize themselves with the terms of their insurance policies, policyholders can ensure that they are properly covered and that their claims are processed smoothly.

Settling for Less than Deserved

It is common for policyholders to make mistakes during the claims process that result in settling for less than they deserve. These mistakes can be costly and can impact the outcome of the claims process. It is important for policyholders to be aware of these mistakes and avoid making them.

undefined

What are some common mistakes that policyholders make during the claims process?

Some common mistakes that policyholders make during the claims process include not reporting the claim promptly, not providing all necessary documentation, not keeping a record of all communication with the insurance company, and not seeking professional help when needed.

Why is it important to report a claim promptly?

It is important to report a claim promptly because any delays can result in the insurance company denying the claim or reducing the amount of compensation. Prompt reporting ensures that the insurance company has all the necessary information to process the claim in a timely manner.

What kind of documentation is necessary during the claims process?

Different claims may require different documentation, but some common types include police reports, medical records, repair estimates, photographs of damage, and any other relevant evidence. It is important to provide all necessary documentation to support your claim and ensure a smooth process.

Why is it important to keep a record of all communication with the insurance company?

Keeping a record of all communication with the insurance company is important because it provides a written record of any agreements or promises made. It can be used as evidence if there are any disputes or discrepancies during the claims process. It also helps you stay organized and keep track of the progress of your claim.

When should a policyholder seek professional help during the claims process?

A policyholder should seek professional help during the claims process if they feel overwhelmed, if the insurance company is not cooperating, if there are any complex legal or technical issues, or if they are not getting the compensation they believe they are entitled to. Professional help, such as hiring a public adjuster or an attorney, can ensure that your rights are protected and help you navigate any challenges during the claims process.