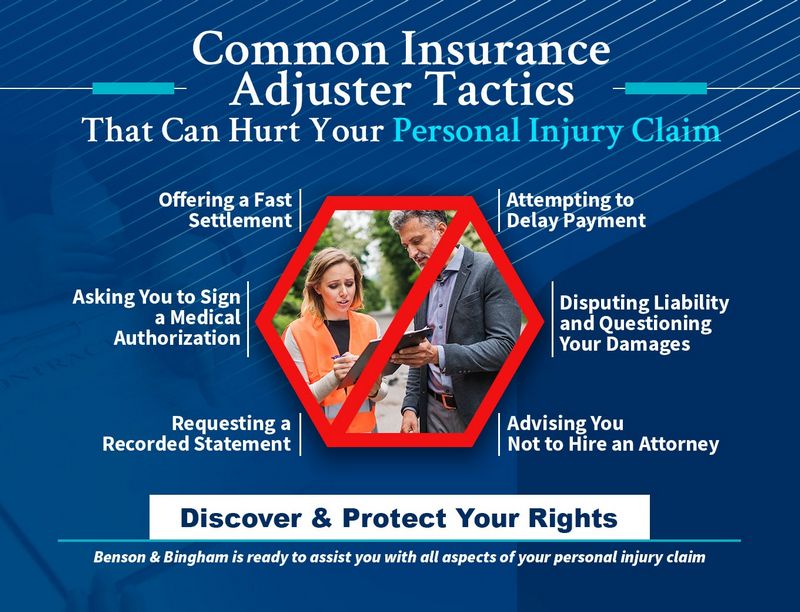

Common Tactics Used by Insurance Claim Adjusters and How to Navigate Them.

Dealing with an insurance claim can be a challenging and stressful process. Insurance claim adjusters are trained professionals who work for the insurance company and their main goal is to minimize the settlement amount paid out to the claimant. They often use various tactics to achieve this.

It is important for claimants to understand these tactics and how to navigate them effectively. By being aware of the common tactics used by insurance claim adjusters, claimants can protect their rights and ensure they receive the compensation they deserve.

One common tactic used by insurance claim adjusters is to downplay the extent of the damages. They may argue that the damages are not as severe as claimed or that they are unrelated to the incident covered by the policy. It is important for claimants to gather as much evidence as possible to support their claim and counter these arguments.

Another common tactic is to delay the claim process. Insurance claim adjusters may use various excuses to prolong the investigation or negotiation period, hoping that the claimant will give up or accept a lower settlement. Claimants should be persistent and keep track of all communication with the insurance company to ensure the claim process moves forward in a timely manner.

Overall, navigating the tactics used by insurance claim adjusters requires knowledge and preparedness. Claimants should familiarize themselves with their policy, gather evidence to support their claim, and consider seeking legal advice when necessary. By being proactive and assertive, claimants can increase their chances of receiving a fair settlement.

Understanding Insurance Claim Adjusters: Who Are They?

When filing an insurance claim, you will likely come across insurance claim adjusters. These individuals play a crucial role in the claims process, as they are responsible for investigating, evaluating, and negotiating insurance claims. Therefore, it is important to understand who they are and how to navigate common tactics used by adjusters.

Insurance claim adjusters are professionals who work for insurance companies. They are typically trained and licensed to handle claims. Their main objective is to protect the interests of the insurance company by minimizing claim payouts. This does not mean that they are biased or against you; they simply have a different perspective and are trained to ensure claims are handled efficiently and in accordance with the insurance policy.

It is essential to approach insurance claim adjusters with professionalism and respect. Keep in mind that they are just doing their job. When dealing with adjusters, it’s important to document everything related to your claim, including conversations, emails, and any evidence supporting your claim. This documentation will help you in case of any disputes or disagreements.

Adjusters often employ various tactics to settle claims in favor of the insurance company. Common tactics include:

1. Delaying the claim process: Adjusters may intentionally prolong the claims process to wear claimants down and push them to accept a lower settlement. It’s important to stay persistent and follow up regularly to avoid unnecessary delays.

2. Questioning the validity of the claim: Adjusters may question or challenge the validity of your claim, requiring additional evidence or documentation. It’s important to provide all the necessary information and be prepared to defend your claim.

3. Offering low settlement amounts: Adjusters may start with a low settlement offer to see if you will accept it. Remember, their goal is to minimize claim payouts. Consider consulting with a professional, such as a lawyer or public adjuster, to determine the fair value of your claim.

4. Using pressure tactics: Adjusters may use pressure tactics to try to force you into accepting a settlement quickly. They may emphasize time constraints or imply that a low initial offer is the best you can get. Take your time to evaluate the offer and consult with a professional before making a decision.

Understanding who insurance claim adjusters are and being aware of their tactics can help you navigate the claims process more effectively. Remember to stay vigilant, document everything, and consider seeking professional advice when necessary. By being well-informed, you can ensure that your rights as a claimant are protected and that you receive a fair settlement for your insurance claim.

Investigating the Insurance Claim: How Do Adjusters Assess the Damage?

Insurance claim adjusters play a vital role in the claims process, as they are responsible for assessing the damage and determining the amount of compensation the insured party is entitled to. Understanding how adjusters assess the damage can help claimants navigate the insurance claim process more effectively.

Adjusters use a variety of tactics to investigate the insurance claim and assess the damage. These tactics commonly include:

| On-site Inspection | Adjusters typically visit the location where the damage occurred to assess the extent of the damage firsthand. They will examine the property, take photographs, and document their findings. |

| Interviewing Witnesses | Adjusters may speak with witnesses who were present when the damage occurred to gather additional information and assess liability. |

| Reviewing Documentation | Adjusters will review any available documentation related to the claim, such as police reports, medical records, and repair estimates, to determine the cause and extent of the damage. |

| Requesting Additional Information | In some cases, adjusters may request additional information from the claimant, such as receipts, invoices, or proof of ownership, to support the claim and assess the damage accurately. |

| Consulting Experts | In complex cases, adjusters may consult with experts, such as engineers or medical professionals, to evaluate the damage and determine the appropriate compensation. |

By understanding these common tactics used by insurance claim adjusters, claimants can better prepare themselves and provide any necessary information or documentation to support their claim. It is crucial to communicate effectively with the adjuster and provide accurate and detailed information to ensure a fair assessment of the damage and a satisfactory resolution to the insurance claim.

Examining Policies and Coverage: What Adjusters Look for

When it comes to insurance claims, one of the most important tasks for adjusters is examining the policies and coverage. Insurance adjusters are trained professionals who have a deep understanding of the ins and outs of policies, and they know the tactics used by claimants to potentially increase their settlements.

Adjusters carefully review the insurance policies to determine the extent of coverage and any limitations or exclusions that may apply. They look for specific details such as the term of the policy, the insured party, the type of coverage, and the policy limits. Understanding these details helps them assess the validity of a claim and make accurate decisions.

Adjusters also pay close attention to the language and wording in the policy. Insurance policies often contain complex legal terms and jargon, which can be confusing for policyholders. Adjusters use this to their advantage, looking for loopholes or ambiguity that may allow them to minimize or deny a claim. They know the common tactics used by claimants to exploit these weaknesses, and they meticulously examine the policies to counter such maneuvers.

Another crucial aspect that adjusters examine is the proof of loss documentation. This includes statements, photos, medical records, and other evidence submitted by the claimants. Adjusters review these documents to determine the validity and accuracy of the claims. They cross-reference the information with the policy coverage, ensuring that all requirements are met and no falsification or exaggeration is present.

The strategies used by insurance claim adjusters are aimed at protecting the insurance company and ensuring that claims are handled fairly and within the policy’s parameters. By carefully assessing policies and coverage, adjusters are equipped to navigate the common tactics used by claimants, resulting in a more accurate and unbiased claims process.

Evaluating Damage: The Techniques Used by Claim Adjusters

When it comes to evaluating damage, claim adjusters employ a variety of techniques that are commonly used in the insurance industry. These tactics enable them to assess and determine the extent of the damage, and ultimately, the compensation that should be provided in the insurance claim.

One of the most common techniques used by claim adjusters is conducting a thorough inspection of the property or vehicle in question. This involves carefully examining all affected areas, taking detailed photographs and measurements, and documenting the condition of the damage. By doing so, claim adjusters can accurately assess the scope of the damage and make informed decisions regarding the claim.

Another technique employed by claim adjusters is reviewing any relevant documentation, including police reports, medical records, and invoices for repairs or medical treatments. This allows them to gather additional information and gain a comprehensive understanding of the circumstances surrounding the claim. By analyzing these documents, claim adjusters can evaluate the validity of the claim and determine the appropriate compensation.

In addition to inspecting the damage and reviewing documentation, claim adjusters may also consult with experts in specific fields, such as contractors, engineers, or medical professionals. These experts provide valuable insights and opinions that help the claim adjuster in assessing the damage accurately and determining the appropriate compensation.

Furthermore, claim adjusters may use databases and software programs specifically designed for evaluating damage. These tools enable them to access relevant information and compare the damage to similar cases or industry standards. By utilizing these resources, claim adjusters can ensure consistency and fairness in their evaluations.

Overall, claim adjusters employ various techniques to evaluate damage and determine the appropriate compensation for insurance claims. By combining thorough inspections, reviewing documentation, consulting experts, and utilizing specialized tools, claim adjusters are able to make informed decisions that uphold the principles of fairness and accuracy in the insurance industry.

Negotiating Settlements: How Adjusters Determine Payouts

When it comes to navigating the tactics used by insurance claim adjusters, understanding how they determine payouts is crucial. Adjusters are trained professionals who work for insurance companies and are responsible for evaluating claims and making settlement offers. By familiarizing yourself with their methods of determining payouts, you can be better equipped to negotiate a fair settlement.

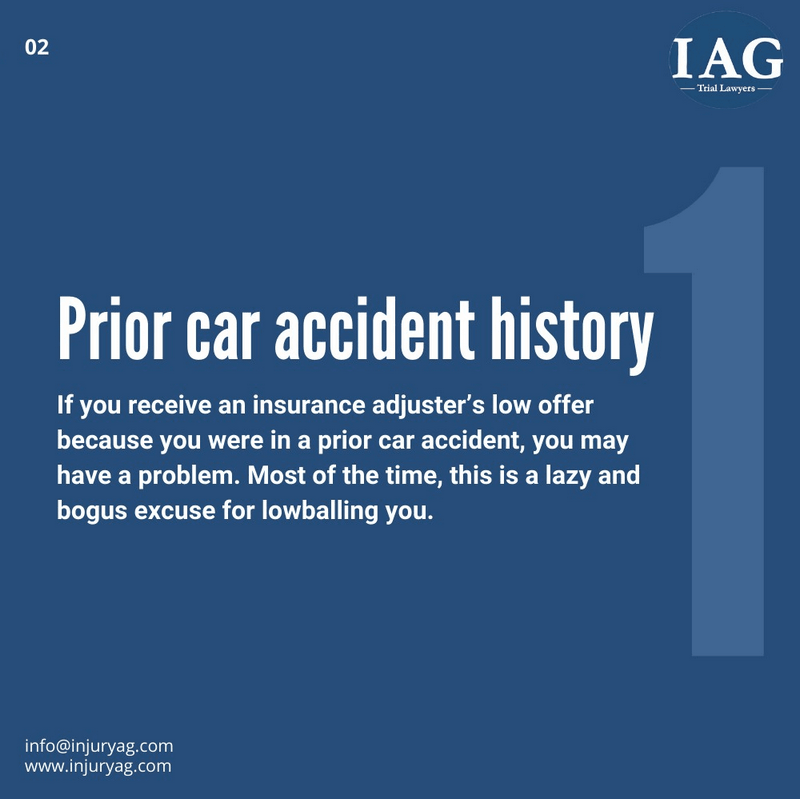

One common tactic used by adjusters is assessing the extent of the damage or injuries claimed in the insurance claim. They will thoroughly review the evidence provided, such as medical records, police reports, and repair estimates. Adjusters will also consider any prior medical history or pre-existing conditions that may have contributed to the claimed injuries.

Another factor that adjusters consider is the policy limits of the insurance coverage. Each insurance policy has a set limit for the maximum amount that can be paid out for a claim. Adjusters will take this into account when determining the final settlement amount. If the claimed damages or injuries exceed the policy limits, the adjuster may be limited in how much they can offer.

Adjusters also analyze comparable cases and settlements to help determine the appropriate payout. They will research similar claims and look at how they were settled in the past. This allows them to establish a baseline for what is considered reasonable and fair compensation in similar situations.

Furthermore, adjusters will often consider the potential costs of going to court. If a claimant is threatening legal action or appears willing to fight for a higher settlement amount, adjusters may be more inclined to offer a larger payout to avoid the time and expense of a legal battle.

It’s important to note that adjusters are trained negotiators, and they may employ various tactics to try to settle a claim for less than what it is worth. They may downplay the extent of the damage or injuries, question the claimant’s credibility, or argue that certain treatments or repairs are unnecessary. Understanding these common tactics can help you navigate negotiations and protect your right to a fair settlement.

In conclusion, understanding the methods adjusters use to determine payouts is essential when navigating the tactics employed by insurance claim adjusters. By familiarizing yourself with their approach, you can be better prepared to negotiate a fair settlement that encompasses all the damages and injuries you have experienced.

Recognizing Common Tactics: What to Watch out for

When dealing with insurance claim adjusters, it’s important to be aware of the common tactics they use. By understanding these tactics, you can navigate through them more effectively and ensure that you receive the compensation you deserve.

Delaying Tactics: One common tactic used by insurance claim adjusters is to delay the claims process. They may request additional documentation, schedule unnecessary meetings, or simply take their time in reviewing your claim. This tactic is often used to frustrate claimants and make them more likely to settle for a lower amount.

Lowball Offers: Another common tactic is for adjusters to offer a settlement amount that is much lower than what the claim is actually worth. They may try to convince you that this is the best you can get, hoping that you will accept a lower amount just to get the process over with. It’s important to remember that you have the right to negotiate and should not settle for less than what you’re entitled to.

Misrepresentation of Facts: Adjusters may also try to twist the facts or misrepresent information in order to weaken your claim. They may downplay the severity of your injuries or argue that the accident was partially your fault. It’s important to gather as much evidence as possible and consult with an attorney, who can help counter these tactics and present a strong case on your behalf.

Pressure Tactics: Adjusters may use pressure tactics to try and speed up the claims process or push you into accepting a settlement. They may claim that the offer on the table is time-limited or threaten to deny your claim altogether. It’s important to stay calm and not let these tactics sway your decision-making. Take the time to review all offers and consult with professionals before making any decisions.

By recognizing these common tactics used by insurance claim adjusters, you can protect yourself and navigate through the claims process more effectively. Remember to stay informed, gather evidence, and consult with professionals who can guide you towards a fair settlement.

Delays and Stalling Tactics: Getting the Runaround

When filing an insurance claim, it’s not uncommon to encounter delays and stalling tactics from insurance claim adjusters. These tactics are used by insurance companies to try to frustrate and discourage policyholders from pursuing their claims.

One common tactic used by insurance claim adjusters is to request unnecessary documentation or information. This can include repeatedly asking for the same documents, or requesting documents that are not relevant to the claim. By doing this, adjusters hope to create confusion and delay the claim process.

Another tactic is for adjusters to purposely delay the processing of the claim by taking a long time to review the documents and information provided. They may also claim that certain documents are missing or incomplete, further stalling the process. This tactic is designed to test the patience and perseverance of the policyholder, in the hopes that they will give up or accept a lower settlement amount.

Insurance adjusters may also use the tactic of giving incomplete or vague responses to policyholders’ inquiries. They may provide limited information or promise to get back to the policyholder at a later date, only to never follow through. This tactic is meant to frustrate the policyholder and make them feel like they are getting the runaround.

It’s important for policyholders to be aware of these tactics and to stay persistent in pursuing their claims. Keeping a detailed record of all communication with the insurance company can help in showing the pattern of delays and stalling tactics. If the tactics continue, it may be necessary to seek legal advice to ensure the claim is handled fairly and promptly.

In conclusion, delays and stalling tactics are common tactics used by insurance claim adjusters. By being aware of these tactics and staying persistent, policyholders can navigate through them and ensure they receive a fair and timely resolution to their insurance claims.

Lowball Offers: Tactics to Settle for Less

When dealing with insurance claims, it is important to be aware of the tactics that adjusters commonly use to try and settle for less than what you deserve. One such tactic is the lowball offer.

An insurance adjuster may present you with a lowball offer, which is an initial settlement amount that is much lower than what you are entitled to. The purpose of this tactic is to test your knowledge and resolve. Adjusters hope that you will accept the offer out of frustration or a lack of understanding of your rights.

It is important not to fall for this tactic. Remember that insurance companies are looking to minimize their expenses and maximize their profits. They may try to undervalue your claim by focusing on minor damages or excluding important factors that should be considered.

To avoid settling for less than you deserve, it is crucial to:

1. Understand the full extent of your claim: Take the time to thoroughly assess the damages and losses you have incurred. This includes not only the visible damages but also the potential long-term effects or hidden damages that may arise in the future.

2. Gather evidence: Document everything related to your claim, including photos, videos, medical reports, repair estimates, and any other relevant evidence that supports your case. This will help you build a strong argument for the true value of your claim.

3. Consult with a professional: Consider seeking help from an experienced insurance claim attorney or public adjuster who can guide you through the process and ensure you receive fair compensation. They have the knowledge and expertise to navigate the tactics used by insurance adjusters.

4. Negotiate: Do not be afraid to negotiate with the adjuster. Present your evidence, explain your position, and counter their lowball offer with a reasonable demand based on the true value of your claim. Be persistent and firm in advocating for what you deserve.

Remember, insurance adjusters are trained to settle claims for as little as possible. By understanding their tactics and being well-prepared, you can navigate the process with confidence and increase your chances of receiving a fair settlement.

Denial of Claims: Reasons for Rejection

When insurance claim adjusters review claims, they use various tactics to determine whether to approve or deny them. It is important for individuals to understand and navigate these common tactics in order to increase their chances of a successful claim.

Here are some common reasons why insurance claims may be denied:

- Lack of coverage: One of the primary reasons for claim denial is when the policy does not cover the type of loss or damage being claimed. It is crucial to carefully review the policy to ensure that the claim falls within the coverage.

- Non-disclosure of information: Insurance policies require individuals to provide accurate and complete information when applying for coverage. If any relevant information is not provided or intentionally omitted, the claim may be denied. It is important to be transparent and provide all necessary details when submitting a claim.

- Policy exclusions: Insurance policies often have specific exclusions that outline situations or events that are not covered. Claims that fall within these exclusions will be denied. It is important to thoroughly review the policy to identify any potential exclusions.

- Untimely filing: Insurance companies typically require claims to be filed within a certain timeframe. Failing to submit a claim within the designated period may result in denial. It is crucial to adhere to the policy’s guidelines for submitting claims promptly.

- Lack of evidence: Insufficient evidence to support the claim is another common reason for denial. Providing thorough documentation, such as photographs, police reports, or medical records, can strengthen the claim and increase the chances of approval.

It is essential for individuals to be aware of these common reasons for claim denial and to take the necessary steps to address them. By understanding and navigating these tactics used by insurance claim adjusters, individuals can increase their chances of having their claims approved.

Misinterpretation of Policy Terms: Tactics to Deny Coverage

When navigating the common tactics used by insurance claim adjusters, it’s important to be aware of their strategies when it comes to misinterpreting policy terms in order to deny coverage. These tactics are frequently employed by insurance claim adjusters to avoid paying out claims, and understanding them can help you protect your rights and ensure fair treatment from your insurance company.

- Policy Ambiguity: Insurance policies can often be complex and filled with industry-specific jargon. Adjusters may use this ambiguity to their advantage, intentionally misinterpreting policy terms to deny coverage. It’s crucial to review your policy thoroughly and consult with a knowledgeable professional to ensure you understand the terms and conditions.

- Selective Quoting: Insurance claim adjusters may selectively quote policy terms to support their denial of coverage. They may conveniently leave out crucial parts of the policy that would have provided coverage for your claim. It’s important for you to have a copy of your policy and familiarize yourself with its contents to counteract this tactic.

- Overemphasizing Exclusions: Adjusters may overemphasize policy exclusions, making them seem broader than they actually are. By focusing on specific exclusions, they may try to convince you that your claim falls under one of them and therefore should not be covered. It’s important to carefully review the policy exclusions and seek a second opinion if necessary.

- Ignorance of State Laws: Insurance claim adjusters may claim that certain state laws or regulations prevent coverage for certain claims, even if those laws don’t actually exist or apply in your situation. It’s important to research and understand the laws in your state to challenge any false claims made by adjusters.

- Unreasonable Interpretation: Some adjusters may make unreasonable interpretations of policy terms to deny coverage. They may rely on technicalities or stretch the meaning of certain terms to fulfill their denial agenda. Consulting with an expert who can provide an unbiased interpretation of the policy can be helpful in these situations.

By staying informed about these tactics and being proactive in reviewing your policy, you can navigate the misinterpretation of policy terms and ensure that your insurance claim is treated fairly.

Pressure Tactics: Pushing for Quick Settlements

When dealing with insurance claim adjusters, it’s crucial to navigate the various tactics they may employ to push for quick settlements. Adjusters are trained professionals who work on behalf of the insurance company to settle claims. Their main goal is to save the insurance company money, which can sometimes result in pressure tactics to get you to accept a quick settlement that may not be in your best interest.

One common pressure tactic adjusters use is time constraints. They may create a sense of urgency by setting tight deadlines for you to provide documentation, make decisions, or accept settlement offers. This tactic is designed to catch you off guard and make you feel like you have to rush into a settlement before fully understanding the extent of your damages or the potential value of your claim.

Another pressure tactic adjusters may employ is downplaying the severity of your injuries or losses. They may try to convince you that your injuries are not as serious as you believe or that your losses are not as significant. This tactic aims to minimize the value of your claim and pressure you into accepting a lower settlement amount. It’s important to remember that adjusters are not medical professionals or experts in assessing the true impact of your injuries or losses.

Adjusters may also use sympathy or empathy tactics to sway your decision-making. They may appear friendly, understanding, and compassionate, attempting to foster a sense of trust. This tactic can make it more challenging for you to question their motives or techniques and can result in accepting a settlement offer that may not fairly compensate you for your losses.

To navigate these pressure tactics used by insurance claim adjusters, it’s crucial to stay informed and be proactive in protecting your rights. It’s essential to thoroughly document your injuries, losses, and damages, and seek independent evaluations or expert opinions to support your claim. Consider consulting with an attorney who specializes in insurance claim disputes to guide you through the process and advocate for your best interests.

Question-answer:

What are some common tactics used by insurance claim adjusters?

Some common tactics used by insurance claim adjusters include delaying the claim process, undervaluing the extent of damages, questioning the validity of the claim, and using intimidating tactics to pressure claimants into accepting low settlement offers.

How do insurance claim adjusters delay the claim process?

Insurance claim adjusters can delay the claim process by requesting unnecessary documentation or information, repeatedly asking for additional evidence, conducting multiple inspections, and taking a long time to review and respond to communications from the claimant.

What can I do if an insurance claim adjuster undervalues the extent of damages?

If an insurance claim adjuster undervalues the extent of damages, you can gather documentation and evidence to support your claim, such as repair estimates from trusted professionals or photographs of the damages. You can also obtain a second opinion or hire an independent appraiser to assess the damages. If necessary, you can file a complaint with your state insurance department or seek legal advice.

What should I do if an insurance claim adjuster uses intimidating tactics?

If an insurance claim adjuster uses intimidating tactics, it is important to stay calm and assertive. Document any incidents of intimidation, including the date, time, and details of the interaction. Maintain clear communication with the adjuster, and if necessary, request to speak with a supervisor or file a complaint with the insurance company. If the intimidation becomes severe or threatening, consider seeking legal counsel.