The Demand for Insurance Adjusters: Industry Trends and Insights.

Insurance adjusters play a crucial role in the insurance industry, helping to determine the extent of damages and the appropriate compensation. As the insurance industry continues to grow, so does the demand for skilled and knowledgeable adjusters.

With the increasing complexity of insurance policies and claims, insurance companies are relying more than ever on adjusters to provide accurate and timely settlements. These professionals have the expertise to assess property damage, investigate accidents, evaluate liability, and negotiate settlements with policyholders.

The demand for insurance adjusters is driven by several factors. One of the main factors is the growing number of insurance claims due to natural disasters, accidents, and other unforeseen events. As these incidents occur more frequently, insurance companies need adjusters who can handle a high volume of claims efficiently.

Another factor contributing to the demand for adjusters is the retiring workforce. Many experienced adjusters are reaching retirement age, creating a need for younger professionals to fill the gap. Insurance companies are actively looking to hire and train the next generation of adjusters to ensure a smooth transition and maintain the quality of service.

Insights from the industry show that adjusters with specialized knowledge and certifications are in particularly high demand. The ability to handle complex claims, such as those involving medical malpractice or product liability, can set adjusters apart from their competitors. Ongoing professional development and staying up-to-date on industry trends are essential for adjusters to remain competitive in the job market.

The demand for insurance adjusters is on the rise, and the industry continues to evolve. To succeed in this field, adjusters need to stay informed, maintain their skills, and adapt to new technologies and regulations. For those with a passion for helping others and a desire for a challenging yet rewarding career, becoming an insurance adjuster can be a lucrative choice.

Trends in Insurance Adjusters Industry

The insurance adjusters industry is constantly evolving, with new trends and challenges emerging each year. Understanding these trends is essential for insurance companies and professionals in the field to stay ahead of the competition and provide the best possible service to their clients.

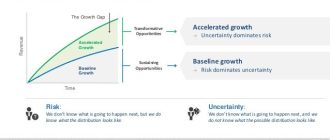

One of the key trends in the insurance adjusters industry is the increasing demand for professionals in this field. As the insurance industry continues to grow, the need for skilled adjusters who can assess and determine the value of claims is becoming more important than ever. This demand is driven by the increasing complexity of insurance policies and regulations, as well as the need for efficient and accurate claim evaluations.

Another trend in the insurance adjusters industry is the shift towards technology and automation. Advancements in artificial intelligence and machine learning have made it possible for insurance companies to automate certain aspects of the claims handling process, such as damage assessment and estimating claim values. This allows adjusters to focus on more complex and specialized tasks, while improving efficiency and reducing costs.

In addition, the insurance adjusters industry is also experiencing a shift towards specialization. As insurance policies become more complex and diverse, adjusters are increasingly specializing in specific areas, such as auto insurance, property insurance, or workers’ compensation. This specialization allows adjusters to develop a deeper understanding of the industry and provide targeted expertise to their clients.

Another important trend in the insurance adjusters industry is the focus on customer experience. Insurance companies are placing a greater emphasis on providing excellent customer service and ensuring a smooth claims process. Adjusters are being trained in communication and empathy skills to better interact with policyholders and provide personalized support throughout the claims process.

Overall, the insurance adjusters industry is experiencing significant trends and changes. The increasing demand for adjusters, the adoption of new technologies, the shift towards specialization, and the focus on customer experience are all shaping the future of the industry. Staying informed and adaptable to these trends is crucial for insurance companies and adjusters to succeed in this evolving landscape.

| Increasing demand | The insurance industry continues to grow, resulting in a higher demand for skilled adjusters. |

| Technology and automation | Advancements in AI and machine learning are automating certain aspects of the claims handling process. |

| Specialization | Adjusters are specializing in specific areas to develop deeper expertise. |

| Focus on customer experience | Insurance companies are emphasizing excellent customer service and personalized support. |

Overview of Insurance Adjusters

Insurance adjusters play a crucial role in the insurance industry, ensuring fair and accurate settlements for policyholders. As the demand for insurance adjusters continues to grow, it’s important to stay informed about industry trends and insights.

Insurance adjusters are professionals who investigate and evaluate insurance claims. They work closely with policyholders, insurers, and other parties involved to determine the extent of damages or losses covered by insurance policies. By examining evidence and conducting interviews, adjusters provide detailed reports that help determine the amount of compensation that should be awarded.

Insights into the insurance industry are essential for insurance adjusters to effectively fulfill their role. The industry is constantly evolving, and adjusters must stay up to date with the latest trends and regulations. Ongoing education and training are vital to ensuring adjusters have the knowledge and skills necessary to handle insurance claims efficiently and accurately.

Understanding the demand for insurance adjusters is crucial for aspiring professionals and those already working in the field. As our society becomes more complex and insurance claims become more frequent, the need for qualified adjusters continues to rise. The demand for adjusters is particularly high in areas prone to natural disasters, as these events often result in a surge of insurance claims.

Industry trends also impact the role of insurance adjusters. Rapid advancements in technology have led to the digitization of many insurance processes. Adjusters must adapt to new software platforms, data analysis tools, and online communication systems to effectively carry out their responsibilities. Additionally, changing social and economic conditions can influence the types and frequency of insurance claims, requiring adjusters to stay flexible and adaptable.

In conclusion, insurance adjusters play a critical role in the insurance industry. By staying informed about industry trends and insights, adjusters can provide invaluable support to policyholders and insurers alike. The demand for adjusters continues to grow, making it an area of opportunity for individuals seeking a dynamic and rewarding career in the insurance field.

Increasing Demand for Insurance Adjusters

In recent years, the insurance industry has experienced a significant increase in the demand for insurance adjusters. As the industry continues to evolve and face new challenges, the need for qualified adjusters has become even more pronounced.

One of the main reasons for this increasing demand is the growing complexity of insurance claims. As insurance policies become more intricate and specialized, the expertise of adjusters is essential in accurately assessing and determining the appropriate level of coverage for various claims.

Additionally, the changing regulatory environment and advancements in technology have also contributed to the rising demand for adjusters. With new laws and regulations being introduced, insurers rely on adjusters to stay up-to-date and ensure compliance. Technological advancements, such as artificial intelligence and data analytics, have also created new opportunities for adjusters to leverage these tools in their work.

Insights from industry experts suggest that the demand for adjusters is expected to continue growing in the coming years. With an increasing number of insurance claims being filed and the need for accurate and efficient claim processing, skilled adjusters will continue to play a crucial role in the industry.

| The complexity of insurance claims |

| Changing regulatory environment |

| Advancements in technology |

| Increasing number of insurance claims |

Overall, the increasing demand for insurance adjusters is driven by various factors, including the intricacy of insurance claims, regulatory changes, technological advancements, and a growing number of insurance claims. As the industry continues to evolve, adjusters will remain in high demand to ensure accurate claim assessments and process claims efficiently.

Key Skills Required for Insurance Adjusters

Being an insurance adjuster requires a unique set of skills and expertise. In order to excel in this industry, professionals must possess a combination of technical knowledge, analytical skills, and interpersonal abilities.

Technical Knowledge:

Insurance adjusters need to have a deep understanding of insurance policies, coverage options, and claim handling procedures. This knowledge allows them to accurately assess damages, determine liability, and negotiate settlements. Additionally, adjusters must be familiar with industry-specific software and tools to process and document claims efficiently.

Analytical Skills:

Insurance adjusters must have strong analytical skills to evaluate the extent of damages and determine fair compensation. They need to analyze policy language, investigate the facts of a claim, and assess the cost of repairs or replacements. These skills help adjusters make informed decisions and ensure the best possible outcome for both the insured party and the insurance company.

Interpersonal Abilities:

Effective communication and interpersonal skills are critical for insurance adjusters. They need to build rapport with claimants, witnesses, and experts to gather accurate information and evidence. Adjusters should be able to explain complex insurance terms and processes in a clear and concise manner to ensure understanding. Additionally, strong negotiation skills are necessary to reach settlements and manage conflicts that may arise during the claims process.

Insights and Industry Trends:

Staying updated with the latest insights and industry trends is vital for insurance adjusters. They need to stay informed about new laws and regulations, emerging technologies, and evolving claim practices. This knowledge helps adjusters adapt to changes, provide accurate assessments, and deliver exceptional service to policyholders.

In conclusion, insurance adjusters must possess the key skills of technical knowledge, analytical abilities, interpersonal skills, and a strong understanding of industry insights and trends. These skills are essential for navigating the complexities of insurance claims and ensuring fair and efficient settlements.

Technology’s Impact on Insurance Adjusters

Technology has become a driving force in the insurance industry, and its impact on insurance adjusters is undeniable. From improving efficiency to enhancing accuracy, technology is revolutionizing how adjusters handle claims and navigate the industry.

One of the key trends in the industry is the increasing demand for adjusters who possess technological expertise. Insurance companies are seeking adjusters who can effectively leverage technology to streamline the claims process and provide better service to policyholders.

With the advent of advanced data analytics and artificial intelligence, adjusters now have access to a wealth of information that can help them assess claims more accurately and efficiently. These tools enable adjusters to identify patterns, detect fraudulent activities, and make data-driven decisions that ultimately benefit both insurers and policyholders.

Another significant impact of technology on insurance adjusters is the introduction of virtual inspections and remote claims handling. Through the use of video calls, photos, and digital documentation, adjusters can assess damages and process claims without the need for an in-person visit. This not only saves time and resources but also improves the overall customer experience by providing faster claim resolutions.

Furthermore, technology has enabled adjusters to work more collaboratively and efficiently with other industry professionals. Through cloud-based platforms and digital collaboration tools, adjusters can easily share information, communicate with stakeholders, and track the progress of claims. This level of connectivity promotes seamless teamwork, reduces administrative burdens, and allows adjusters to provide more timely and accurate updates to policyholders and insurers.

In conclusion, technology’s impact on insurance adjusters is transforming the industry by enhancing efficiency, accuracy, and collaboration. As the industry continues to evolve, adjusters who possess technological skills and embrace these advancements will be in high demand. By leveraging technology, adjusters can navigate the ever-changing landscape of insurance with confidence and meet the increasing expectations of policyholders and insurers.

Emerging Roles in Insurance Adjusting

As the insurance industry continues to evolve and adapt to changing market dynamics, the role of insurance adjusters is also experiencing a transformation. With new insights and advancements in technology, there is a growing demand for adjusters who possess a diverse skill set and can effectively navigate emerging trends in the insurance landscape.

One of the emerging roles in insurance adjusting is that of a data analyst. With the increasing importance of data-driven decision making in the industry, insurance companies are seeking adjusters who can effectively analyze and interpret large volumes of data to better understand trends, patterns, and risks. A data analyst adjuster can provide valuable insights to insurers and help drive more informed decision making.

Another emerging role is that of a digital adjuster. With advancements in technology, such as artificial intelligence and machine learning, digital adjusters are able to streamline the claims process and provide faster and more accurate estimates. These adjusters are skilled in using digital tools and software to efficiently assess damages, calculate payouts, and communicate with policyholders and other stakeholders.

The demand for specialized adjusters, such as catastrophe adjusters, is also on the rise. With the increasing frequency and severity of natural disasters, there is a need for adjusters who are experienced in handling complex and large-scale claims resulting from events like hurricanes, wildfires, and floods. These adjusters are trained to quickly assess damages, coordinate resources, and provide prompt assistance to policyholders in times of crisis.

As the insurance industry continues to evolve, so too will the roles and responsibilities of adjusters. By staying informed about emerging trends and acquiring new skills, insurance adjusters can position themselves as valuable assets to insurance companies and contribute to the continued success of the industry.

Challenges Faced by Insurance Adjusters

Being an insurance adjuster can be a demanding and rewarding career choice. However, there are several challenges that insurance adjusters face on a daily basis.

- Increased workload: With the current trends and insights in the insurance industry, the demand for insurance adjusters has been on the rise. As a result, adjusters often find themselves handling a high volume of claims, leading to increased workload and potential stress.

- Complexity of claims: Insurance claims can be complex and involve various parties, policies, and legal considerations. Insurance adjusters must navigate through the intricacies of each claim to ensure fair settlements, which can be challenging and time-consuming.

- Dealing with difficult clients: Insurance adjusters often have to interact with clients who may be upset, frustrated, or even hostile due to their claims being denied or delayed. Adjusters need to exercise patience, empathy, and excellent communication skills to effectively manage these situations.

- Constant learning: The insurance industry is constantly evolving, with new trends, regulations, and technologies emerging. Insurance adjusters need to stay updated with industry insights to provide accurate assessments and recommendations, which requires continuous learning and professional development.

- Public perception: Insurance adjusters are sometimes viewed negatively by policyholders who feel their claims are undervalued or unfairly denied. Dealing with the public’s perception and managing expectations while maintaining professionalism can be challenging for adjusters.

Despite these challenges, the demand for insurance adjusters continues to grow. With the right skills, knowledge, and support, insurance adjusters can overcome these challenges and make a significant impact in the industry.

The Future of Insurance Adjusters

As the insurance industry continues to evolve, the demand for skilled insurance adjusters is expected to increase. With new technologies and changing customer needs, insurance adjusters will need to adapt and learn new skills to stay relevant in the industry.

Insights into industry trends indicate that insurance companies are shifting towards a more customer-centric approach. This means that insurance adjusters will not only need to have a deep understanding of insurance policies and claims processes but also exceptional communication and customer service skills.

One trend that is expected to have a significant impact on insurance adjusters is the increased use of artificial intelligence and automation. While these technologies can streamline processes and improve efficiency, they also raise questions about the future role of adjusters. However, the human touch and expertise that insurance adjusters provide cannot be fully replaced by machines.

Another trend that adjusters should be aware of is the changing demographics of insurance customers. As millennials become a larger part of the market, adjusters will need to tailor their approaches and services to meet the expectations and preferences of this generation. This may include using digital tools, offering online claim filing options, and providing real-time updates via mobile apps.

In conclusion, the future of insurance adjusters is both challenging and promising. While there may be changes in the industry, the demand for skilled adjusters will continue to grow. Adjusters who stay updated with industry insights, trends, and technologies will be well-positioned to adapt and thrive in this evolving industry.

Training and Education for Insurance Adjusters

As the demand for insurance adjusters continues to grow, it is essential that professionals in this industry stay up-to-date with the latest insights and trends. The insurance industry is constantly evolving, and adjusters need to possess the necessary skills and knowledge to effectively assess and handle claims.

Training and education play a crucial role in ensuring that insurance adjusters are equipped with the tools they need to excel in their roles. Many employers require adjusters to have a bachelor’s degree in a related field, such as business administration, finance, or risk management. These programs provide a solid foundation in insurance principles, policy interpretation, and claims management.

In addition to formal education, ongoing training and professional development are vital for insurance adjusters. Continuous learning helps adjusters stay updated on industry regulations, emerging technologies, and best practices. Adjusters can attend seminars, workshops, and conferences to expand their knowledge and network with other professionals.

Insurance adjusters can also pursue professional certifications to enhance their credentials and demonstrate their expertise. Organizations such as the American Institute for Chartered Property Casualty Underwriters (AICPCU) offer certifications like the Associate in Claims (AIC), which validates adjusters’ knowledge and proficiency in claims handling.

Furthermore, insurance adjusters can benefit from on-the-job training and mentorship programs. Working alongside experienced adjusters allows new professionals to gain practical skills and learn from real-life scenarios. Mentorship programs offer guidance and support, helping adjusters navigate the intricacies of the industry.

In conclusion, training and education are essential components for insurance adjusters to keep pace with the evolving industry. By investing in their professional development, adjusters can stay ahead of industry trends, provide valuable insights to their clients, and meet the growing demand for their services.

Insurance Adjusting as a Lucrative Career Option

Insurance adjusting is quickly emerging as a lucrative career option in the insurance industry. As per the insights into industry trends, the demand for insurance adjusters has been on the rise in recent years.

Insurance adjusters play a crucial role in assessing and evaluating insurance claims. Their primary responsibility involves investigating the details surrounding an insurance claim, examining policies, assessing damages, and negotiating settlements with the claimants.

With the increasing number of insurance claims and the complexity involved in assessing them, the demand for skilled insurance adjusters has witnessed a significant surge. The growth in the insurance sector has also contributed to this upward trend.

One of the key reasons why insurance adjusting is considered a lucrative career option is the potential for high earnings. Insurance adjusters often have the opportunity to earn competitive salaries, especially for those with experience and expertise. The more claims an adjuster can handle, the higher their income potential becomes. Additionally, as insurance adjusters gain experience and develop a reputation for delivering accurate assessments and fair settlements, they may be able to negotiate higher fees for their services.

Furthermore, insurance adjusting offers a flexible work schedule, allowing adjusters to have a better work-life balance. While there may be times when adjusters need to work long hours or handle claims during weekends, they also have the flexibility to manage their workload and choose when to work on assignments.

It is important to note that insurance adjusting requires a blend of technical knowledge, analytical skills, and excellent communication abilities. Adjusters need to possess a thorough understanding of insurance policies, construction materials, and industry regulations. They must also have strong negotiation skills to ensure fair settlements for both insurers and claimants.

In conclusion, insurance adjusting presents a promising career option in the insurance industry. With the insights into industry trends indicating a growing demand for adjusters, individuals with a passion for insurance, a knack for investigation, and strong analytical abilities can thrive in this field. The potential for high earnings, flexible work schedules, and the opportunity to make a significant impact through fair claims assessments make insurance adjusting an attractive career choice.

Insurance Adjusting vs. Other Industry Careers

Insurance adjusting is a career path that offers unique opportunities and challenges compared to other industries. While many industries have a continuous demand for professionals, the insurance industry specifically requires a constant supply of skilled adjusters to meet the needs of policyholders.

Insights from the industry indicate that the demand for insurance adjusters is consistently high. This is due to multiple factors such as natural disasters, accidents, and other unexpected events that result in insurance claims. Adjusters play a crucial role in assessing and determining the validity of these claims, ensuring a fair resolution for the policyholders.

Compared to other industry careers, insurance adjusting offers distinct advantages. One of the main benefits is the stability of the insurance industry itself. Insurance is a necessity in today’s society, meaning there will always be a demand for adjusters to handle claims and provide support to policyholders.

Unlike some industries that may be affected by economic downturns or fluctuations, the demand for insurance adjusters remains relatively constant. This stability provides a sense of security for professionals in the field, making it an attractive career choice for those seeking long-term stability.

| Consistent demand due to insurance claims | Varied demand based on industry trends |

| Stability in the insurance industry | Potential for economic fluctuations |

| Opportunity to assist and support policyholders | Varied job roles and responsibilities |

| Constant need for skilled professionals | Dependent on industry-specific skills |

Furthermore, insurance adjusting provides the opportunity to directly assist and support policyholders during difficult times. Adjusters are often on the front lines, meeting with individuals and families who have experienced loss or damage. This hands-on aspect of the job can be rewarding for those who are passionate about helping others.

Lastly, the constant need for skilled professionals in the insurance industry makes insurance adjusting an attractive career path. As the industry evolves and new challenges arise, there will always be a demand for professionals who can adapt and provide valuable insights.

In summary, insurance adjusting offers unique advantages compared to other industry careers. From consistent demand and stability in the industry to the opportunity to support policyholders and the need for skilled professionals, this career path provides a promising future for those interested in the insurance industry.

undefined

What are the industry trends in the demand for insurance adjusters?

The demand for insurance adjusters is currently on the rise. With an increase in natural disasters and insurance claims, there is a need for more adjusters to assess and process these claims. Additionally, as technology advances, there is a shift towards automated processes, creating a need for adjusters with technical skills to handle complex claims.

What insights can you provide about the insurance adjuster industry?

The insurance adjuster industry is a dynamic field that requires a combination of technical skills, analytical thinking, and excellent communication abilities. As an insurance adjuster, you will be responsible for investigating and evaluating insurance claims, determining the validity and coverage of claims, and negotiating settlements with policyholders and claimants.

Is there a shortage of insurance adjusters in the industry?

There is currently a shortage of insurance adjusters in the industry. The increasing number of natural disasters and insurance claims has created a higher demand for adjusters, while the number of trained professionals entering the field has not kept pace. This shortage presents an opportunity for individuals interested in pursuing a career as an insurance adjuster.

What are the necessary qualifications and skills to become an insurance adjuster?

To become an insurance adjuster, you typically need a bachelor’s degree in a related field such as finance, business, or economics. Additionally, on-the-job training and completing industry certifications can help you acquire the necessary skills to succeed in this role. Strong communication skills, attention to detail, and the ability to negotiate settlements are also essential for insurance adjusters.

How is technology impacting the insurance adjuster industry?

Technology is playing a significant role in the insurance adjuster industry. The use of data analytics and artificial intelligence is transforming the way claims are processed and assessed. This has led to increased efficiency in claims handling and improved accuracy in determining claim value. However, it also means that adjusters need to adapt to these technological changes and acquire the necessary skills to work with automated systems.